- #How to calculate gst in excel how to

- #How to calculate gst in excel professional

- #How to calculate gst in excel free

- #How to calculate gst in excel windows

Once you’ve opened a new spreadsheet using your selected template, you’ll need to edit the invoice to reflect the details of your project. Once you’ve chosen a template that works for you, click on the template to preview it and then hit the “Create” button to open the Excel template in a new window. Choose a template that fits your needs and has a design that fits with your company branding. Excel offers a range of invoice templates, from sales invoices to service invoices and shipping invoices. Scroll through the different invoice template options to find one that works for your business. Make sure you’re connected to the internet to perform the search. Once Excel is open on your computer, use the search bar that’s located at the top of the window and enter “invoice” to find invoice templates. To begin making an invoice from an Excel template, you’ll first need to launch Microsoft Excel on your PC.

#How to calculate gst in excel windows

To create an invoice from an Excel template on a Windows PC, follow these steps: 1.

#How to calculate gst in excel how to

How to Create an Invoice in Excel from Scratchįree Microsoft Excel Invoice Templates How to Make an Invoice from an Excel Template (Windows)īusinesses can use customizable Excel templates to invoice their customers. How to Make an Invoice from an Excel Template (Mac) How to Make an Invoice from an Excel Template (Windows) Learn how to create an invoice in Excel with these invoicing topics:

#How to calculate gst in excel professional

You can either use a customizable Excel invoice template or create your own professional invoice from scratch. We will try our level best to solve the problem or work with your suggestions.Small businesses can create their own invoices in Microsoft Excel to start billing clients for their services.

#How to calculate gst in excel free

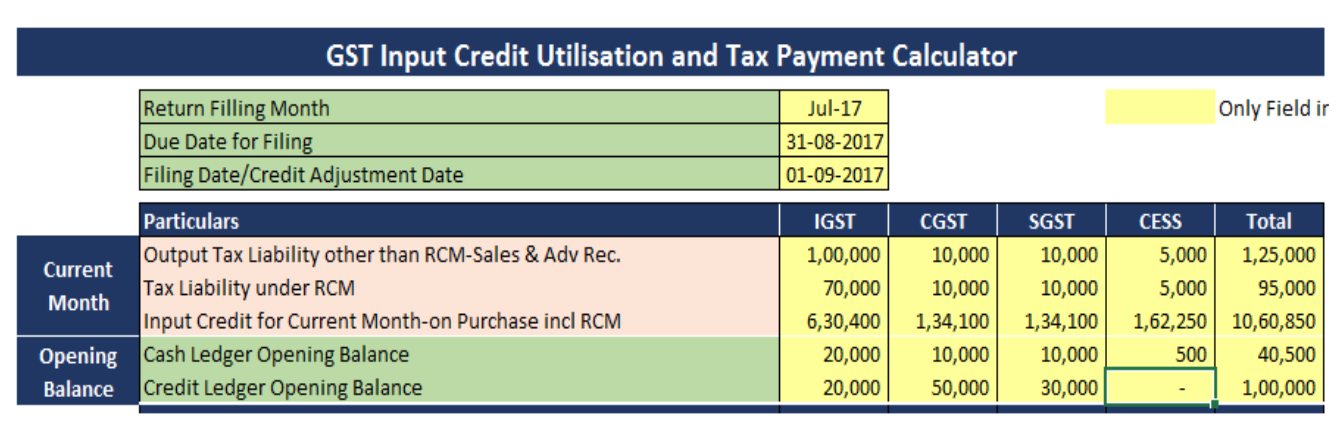

Please feel free to add comments, suggestions, or questions in the section below if you have any confusion or face any problems. Follow the ExcelDemy website for more articles like this. We will be glad to know if you can execute the task in any other way. Hopefully, these methods will help you to calculate GST in excel. Henceforth, follow the above-described methods. But if we have to determine the GST Rate, you have to arrange the price with and without GST.Even we can change the GST Rate accordingly to get the desired result. If we know the GST Rate, then we will determine the Price With GST by following the first process.Read More: Creating GST Purchase Order Format in Excel (Free Template) Eighth, you will result for that cell and use the Fill Handle option to apply to all desired cells.Second, insert the following formula into cell E5.At first, insert the desired GST Rate in column D.We can fulfill that by following the below steps. Now, we want to calculate the GST amount in excel. Read More: How to Create GST Rental Invoice Format in Excel These three columns are the main factors in calculating GST in excel. In Column D we have GST Rate, in Column E we have GST Amount and in Column F we have Price With GST. Next, we have to create three important columns.First, we have the Products in Column B and the Price Without GST in Column C.But to do so, we need a dataset on which we will work. In this case, our goal is to calculate GST. The steps are: Step 1: Arranging Proper Dataset If you follow the steps correctly, you should learn how to calculate GST in excel on your own. Step-by-Step Procedures to Calculate GST in Excel So, overall it creates a uniform market which increases the manufacturing process and thus increases exports and imports businesses. Moreover, it gives a level playing field to small traders. It also reduces corruption and illegal money laundering.

The purpose of GST is to simplify the taxation process and bring more business models under legal authorization. It is the added tax imposed on domestic goods and services.

0 kommentar(er)

0 kommentar(er)